Table of Contents

As IT systems become more central to growth and competitiveness, more companies are working with external technology vendors to accelerate delivery and access specialized expertise. The global IT outsourcing market continues to expand as organizations adopt cloud, AI, and digital platforms—while internal engineering capacity struggles to keep pace.

From our position as an IT outsourcing vendor, we see a consistent pattern: the success of an engagement depends heavily on how the vendor is selected, structured, and set up from day one. Misalignment around expectations, IT delivery models, or governance often causes issues long before technical challenges appear. This guide outlines the fundamental criteria and processes companies use to select IT vendors effectively—and what a professional vendor should be able to demonstrate in return.

Key Takeaways

- IT vendor selection is a strategic decision, not a procurement formality. The right process reduces delivery risk, security exposure, and long-term technical debt

- Effective IT vendor evaluation criteria go beyond pricing. Delivery capability, engineering quality, security readiness, and execution discipline are stronger predictors of success than cost alone.

- A weighted scoring model improves objectivity. Assigning clear weights and thresholds helps teams compare vendors fairly and avoid subjective or politically driven decisions.

- Industry context matters. Vendor selection criteria should be adjusted based on regulatory pressure, performance requirements, and operational complexity specific to each industry.

- A structured evaluation process creates clarity. Filtering, RFI/RFP/RFQ usage, scoring, and live vendor discussions progressively reduce uncertainty before commitment.

Why You Need the Right IT Vendor Evaluation Process?

Choosing the right IT vendor is one of the most strategic decisions a tech-enabled organization can make—because the wrong choice can cost far more than money. Good selection is not optional—it’s foundational. Here’s why:

- IT Vendor Selection Is a Risk Management Imperative

When you work with external partners, you’re not just buying services—you’re sharing access to critical systems, data, and business outcomes. Poorly chosen vendors introduce many risks, from operational disruption to security exposure. Today’s business environment makes this challenge even more complex: third-party risk now includes cybersecurity exposure, compliance obligations, strategic misalignment, and reputational impact. Formal vendor risk management is now a mainstream discipline precisely because of these pressures.

Without a thoughtful vendor selection process, organizations often end up in reactive mode, scrambling to address issues that could have been anticipated in advance.

- Structured Selection Reduces Operational Delays and Hidden Costs

A vendor selection process forces teams to evaluate capabilities and constraints systematically before engagement. According to procurement frameworks, strategic vendor selection reduces the likelihood of disruptions, delays, and quality issues. It also helps organizations avoid low-quality or unsuitable vendors, which can silently inflate cost through rework, missed deadlines, or scope gaps.

This matters especially for IT functions where delivery delays ripple through product launches, compliance cycles, and business operations.

- Quality and Strategic Alignment Drive Long-Term Success

The right vendor selection process goes beyond cost negotiation. It involves comparing vendors against criteria such as technical capability, past performance, financial stability, cultural fit, and alignment with strategy. Research consistently shows that companies with structured vendor evaluation experience better operational performance and stronger outsourcing outcomes.

For example, organizations that use formal criteria and due diligence are significantly more likely to choose vendors that can deliver both short-term execution and long-term value—helping avoid future transitions that are costly in time and budget.

- Better Selection Strengthens External Trust and Internal Confidence

A formal vendor selection process also builds confidence across the organization. When stakeholders see that choices are based on data, documented criteria, and verified capabilities, trust grows in the vendor relationship and among internal teams. This is especially important in IT, where cross-functional cooperation (security, legal, product, finance) is required before onboarding new technology partners.

- Real Market Trends Reinforce the Need for Selection Discipline

The global IT outsourcing market continues to grow rapidly, with projections into the hundreds of billions of dollars as companies pursue digital transformation and operational efficiency. With that scale comes greater diversity in vendor capabilities and quality levels, making disciplined selection more important than ever.

At the same time, many organizations are scrutinizing vendor relationships more closely—especially in areas like cybersecurity, where vendor weakness can be a major exposure point.

In short, a strong IT vendor selection process protects your business by reducing risk, improving quality, increasing alignment with strategic goals, and reducing hidden costs. It turns vendor choice from a transactional purchase into a predictable, value-driven decision.

Fundamental IT Vendor Selection Criteria

The right IT vendor is not defined by price, brand size, or promises—it is defined by its ability to deliver outcomes reliably under real-world constraints. A strong evaluation framework looks beyond surface-level metrics and examines how a vendor performs across strategy, execution, risk, and long-term partnership.

Below is a unified set of criteria that covers what actually matters when choosing an IT vendor. Explore IT Outsourcing Guide for more insights!

1. Strategic Understanding and Value Alignment

The first signal of a strong vendor is how they frame your problem. Good vendors don’t jump straight into solutions—they clarify objectives, constraints, and trade-offs.

What to look for:

- Ability to restate your goals in business terms, not just technical scope

- Awareness of constraints such as time, compliance, legacy systems, and change rate

- Focus on value delivered, not just features built

Vendors that understand value early tend to price more realistically and make better decisions when scope inevitably changes.

2. Delivery Capability and Execution Discipline

Many vendors can build software. Fewer can deliver it consistently.

This criterion evaluates whether the vendor has repeatable execution, not heroic effort:

- Clear delivery process (planning, reviews, escalation, risk handling)

- Realistic estimation practices

- Proven ability to handle scope changes without chaos

Delivery punctuality is a symptom of this discipline—not a separate metric. Vendors who deliver on time do so because their execution model absorbs uncertainty well.

3. Engineering Quality and Product Sustainability

You are not buying code; you are buying a system you must live with.

Evaluate how the vendor ensures:

- Maintainable architecture and clean boundaries

- Code review, testing, and quality standards

- Ability to scale, integrate, and evolve the system

Product quality and vendor performance are inseparable. Vendors who lack engineering discipline eventually trade speed for technical debt—and the cost always comes back to you.

4. Scope of Services and Lifecycle Coverage

A vendor’s service range matters, but only when it is coherent.

What matters is whether the vendor can support:

- Early discovery and technical direction

- Build, test, deploy, and stabilize

- Ongoing maintenance, optimization, and scaling

A narrow vendor can work—but only if responsibilities are crystal clear. Gaps in service coverage often become hidden risks during handovers or growth phases.

5. Security, Compliance, and Third-Party Risk Readiness

Modern IT vendors operate inside your risk perimeter.

You should assess:

- How data is handled, stored, and accessed

- Security practices and incident response readiness

- Awareness of compliance and third-party risk expectations

Security maturity is not about certifications alone. It is about whether controls are operational and embedded into daily delivery.

6. Organizational Maturity and Business Presence

This is where business presence and financial stability intersect.

Evaluate:

- Legal structure, governance, and transparency

- Financial health and ability to retain talent

- Stability of leadership and delivery teams

You don’t need the largest vendor—but you need one that won’t disappear, reshuffle teams abruptly, or collapse under market pressure.

7. Team Quality, Continuity, and Knowledge Retention

Many engagements fail because the “A team” appears only during sales.

Key signals:

- Who will actually work on your project

- How turnover is handled

- How knowledge is documented and retained

Strong vendors design for continuity. Weak vendors rely on individuals—and that creates fragile delivery.

8. Communication Systems and Client Experience

Customer service in IT is not about friendliness—it’s about accountability.

Assess:

- Clarity of communication channels and escalation paths

- Responsiveness when issues arise

- Transparency in reporting progress and risks

Good client experience shows up when things go wrong. Vendors who own problems instead of deflecting them are rare—and valuable.

9. Commercial Model and Cost Predictability

Pricing matters, but predictability matters more.

Look beyond rates and assess:

- Alignment between pricing model and delivery reality

- Transparency in what is included and excluded

- Change management and cost control mechanisms

The best vendors price honestly and explain trade-offs. The worst underprice early and renegotiate later.

>>> Related: IT Outsourcing Cost: A Comprehensive Guide

10. Reputation, References, and Real Recommendations

Finally, validate everything above.

Strong signals include:

- References from similar projects and constraints

- Case studies with measurable outcomes

- Willingness to connect you with delivery stakeholders

Reputation alone is not enough. Relevant recommendations are one of the most reliable predictors of future performance.

How to Use This Framework Effectively

These criteria should not be evaluated independently. They reinforce each other:

- Pricing must align with delivery discipline

- Service scope must match organizational maturity

- Engineering quality must be supported by team continuity

- Recommendations should confirm real execution, not marketing claims

The goal is not to find a perfect vendor—but to choose one whose strengths align with your risks.

How to Evaluate IT Vendors Based on Industry?

Not all industries carry the same risks, constraints, or success metrics. An IT vendor that performs well in one sector may struggle in another if industry-specific requirements are ignored during selection.

Use the table below to adjust your evaluation focus based on your industry context.

Industry-Based Vendor Evaluation Matrix

| Industry | Key Risks & Constraints | What to Evaluate More Closely | Notes from Practice |

| FinTech / Banking | Regulatory compliance, data security, auditability | Security architecture, compliance experience, change control, audit trails | Prior experience with regulated environments matters more than speed |

| Healthcare / HealthTech | Data privacy, interoperability, reliability | HIPAA/GDPR awareness, data handling, system uptime, integration standards | Vendors must understand clinical workflows, not just technology |

| E-commerce / Retail | Traffic spikes, performance, conversion sensitivity | Performance engineering, scalability, release reliability | Speed matters, but downtime costs revenue immediately |

| SaaS / B2B Platforms | Maintainability, scalability, rapid iteration | Architecture design, DevOps maturity, long-term ownership | Look for vendors who design for multi-tenancy and growth |

| Enterprise / Corporate IT | Integration complexity, governance, change resistance | Documentation, integration capability, stakeholder management | Communication discipline is often more critical than raw speed |

| Manufacturing / Industrial | System stability, hardware integration, long lifecycles | Reliability, legacy integration, long-term support model | Vendors must be comfortable with slower change cycles |

| Education / EdTech | Budget constraints, usability, seasonal traffic | Cost predictability, UX design, scalability | Simple solutions that scale at peak usage outperform complex ones |

| Media / Content Platforms | High content volume, real-time delivery | Performance tuning, CDN integration, release cadence | Time-to-publish and system resilience are critical |

| Government / Public Sector | Procurement rules, compliance, transparency | Documentation, audit readiness, delivery predictability | Process discipline outweighs innovation speed |

This industry layer is not a separate scoring system. Instead:

- Keep the core weighted criteria unchanged

- Adjust weights or thresholds for industry-critical dimensions

- Add industry-specific evidence requirements during evaluation

IT Vendor Evaluation Example

- FinTech → increase Security weight from 15% → 25%

- E-commerce → raise Engineering Quality & Performance thresholds

- Government → require documentation and audit evidence before scoring above 4

This keeps your evaluation consistent while respecting real-world differences.

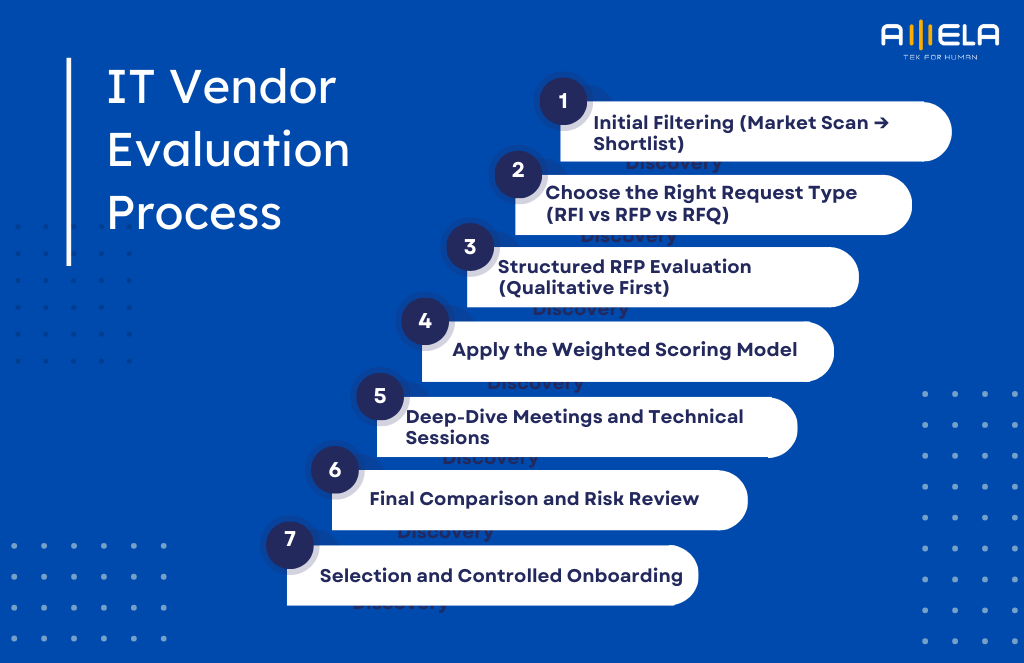

IT Vendor Evaluation Process: From Shortlist to Final Decision

A strong evaluation process turns your selection criteria into real decisions. Without a clear process, even the best criteria and scoring models collapse into subjective debates, rushed choices, or price-driven compromises. The goal of this process is simple: reduce uncertainty step by step until one vendor clearly stands out.

Below is a practical, end-to-end evaluation flow used by mature product and IT teams.

Step 1: Initial Filtering (Market Scan → Shortlist)

This stage answers one question: Who is even worth evaluating?

Actions:

- Scan the market using referrals, research, and prior experience

- Eliminate vendors that clearly don’t fit (wrong scale, wrong industry, wrong geography)

- Create a shortlist of 3–6 vendors—more than that slows decisions without improving quality

Filtering criteria at this stage should be binary, not nuanced:

- Do they work in your industry?

- Do they support your required technology stack?

- Do they meet baseline security and compliance needs?

This step saves time later by avoiding deep evaluation of unsuitable vendors.

Step 2: Choose the Right Request Type (RFI vs RFP vs RFQ)

Not every situation requires a full RFP. Choosing the right format improves signal quality.

| Request Type | Purpose | When to Use |

| RFI (Request for Information) | Understand capabilities and approaches | Early exploration, unclear scope |

| RFP (Request for Proposal) | Compare delivery approach, team, and solution | Most IT projects and outsourcing decisions |

| RFQ (Request for Quotation) | Compare pricing only | Well-defined scope, low complexity |

In most IT vendor selections, RFP is the core document. It balances technical understanding, delivery approach, and commercial clarity—without over-focusing on price.

Step 3: Structured RFP Evaluation (Qualitative First)

When responses arrive, resist the urge to jump straight to cost comparison.

First, evaluate:

- Understanding of your problem

- Proposed delivery approach and assumptions

- Team structure and role clarity

- Risk identification and mitigation

At this stage, remove vendors that:

- Misinterpret your requirements

- Provide generic or copy-paste responses

- Avoid discussing risks or constraints

This narrows the field before scoring begins.

Step 4: Apply the Weighted Scoring Model

Now convert evaluation into numbers. Not all criteria matter equally. In IT vendor selection, delivery, quality, and risk should outweigh cost or brand name.

- Define the Evaluation Dimensions and Weights

Here’s a balanced weighting model that works well for most software development and IT outsourcing scenarios:

| Evaluation Dimension | Weight (%) | Why It Matters |

|---|---|---|

| Strategic understanding & value alignment | 10% | Ensures the vendor builds the right thing, not just what’s written |

| Delivery capability & execution discipline | 20% | Strongest predictor of on-time, predictable delivery |

| Engineering quality & sustainability | 20% | Protects long-term maintainability and scalability |

| Security, compliance & risk readiness | 15% | Reduces operational, legal, and reputational risk |

| Team quality & continuity | 10% | Prevents delivery breakdown due to turnover |

| Communication & client experience | 10% | Keeps execution transparent and issues manageable |

| Commercial model & cost predictability | 10% | Ensures realistic budgeting over time |

| Reputation & relevant references | 5% | Validates real-world performance |

Total: 100%

Tip: Adjust weights slightly depending on context. For regulated industries, increase security weight. For early-stage products, increase delivery and team weights.

- Score Each Vendor Consistently

Use a 1–5 scoring scale for each criterion:

| Score | Meaning |

|---|---|

| 1 | Very weak / high risk |

| 2 | Below expectations |

| 3 | Acceptable / average |

| 4 | Strong |

| 5 | Excellent / low risk |

- Calculate Weighted Scores

For each criterion: Weighted Score = (Score ÷ 5) × Weight

- Example (Delivery Capability – 20% weight):

Vendor A score: 4 → (4 ÷ 5) × 20 = 16

Vendor B score: 3 → (3 ÷ 5) × 20 = 12

Repeat this for all criteria and sum the results.

This step does two things:

- Makes trade-offs visible

- Prevents “nice presentation” bias

Scoring should be done independently by multiple stakeholders, then discussed to align perspectives.

Step 5: Deep-Dive Meetings and Technical Sessions

With 2–3 top candidates remaining, move into live interaction.

Recommended sessions:

- Delivery deep dive (with the actual team, not just sales)

- Technical architecture discussion

- Security and compliance walkthrough

- Commercial and change-management discussion

The goal here is not selling—it’s stress-testing assumptions. Pay attention to how vendors respond to tough questions or uncertainty.

Step 6: Final Comparison and Risk Review

Before choosing, step back and review:

- Where does each vendor score highest—and lowest?

- Which risks are acceptable vs unacceptable?

- What trade-offs are you consciously making?

A simple final comparison table often clarifies the decision more than long discussions.

Step 7: Selection and Controlled Onboarding

Once a vendor is chosen:

- Align on scope, success metrics, and communication cadence

- Confirm escalation paths and governance model

- Start with a pilot phase or limited engagement when possible

This ensures the evaluation logic carries through into delivery.

Why This Process Works

This evaluation process:

- Reduces emotional and price-only decisions

- Aligns business, technical, and procurement stakeholders

- Surfaces risks early, when they are cheap to fix

Vendor selection is not about choosing who looks best—it’s about choosing who fails least under pressure.

Conclusion

A strong IT vendor selection process creates the foundation for successful delivery. Clear criteria, structured evaluation, and realistic expectations help ensure that the vendor relationship starts with alignment, transparency, and execution discipline.

As an IT outsourcing partner, we believe our responsibility goes beyond delivering code. We work with clients to set up teams, processes, communication models, and governance structures professionally—so delivery is predictable, scalable, and sustainable from the beginning.

If you’re considering IT outsourcing, working with a vendor that understands how to structure and run delivery—not just build software—can make a decisive difference in long-term outcomes.

FAQs:

What is IT vendor selection?

IT vendor selection is the structured process of identifying, evaluating, and choosing an external technology partner that can deliver required outcomes with acceptable risk. It goes beyond comparing prices and focuses on delivery capability, quality, security, and long-term fit.

What is the most fundamental criterion in IT vendor selection?

The most fundamental criterion is delivery reliability—the vendor’s ability to deliver quality outcomes consistently under real-world constraints. Pricing, size, or brand matter far less if a vendor cannot execute, manage change, and communicate clearly.

What are the biggest mistakes companies make in IT company selection?

Common mistakes include:

- Choosing based on price alone

- Evaluating sales presentations instead of delivery teams

- Skipping security and continuity checks

- Ignoring industry-specific constraints

- Not validating claims with references or evidence

These mistakes usually surface later as quality issues or missed deadlines.

How many companies should be shortlisted?

A shortlist of 3–6 vendors is usually ideal. Fewer limits comparison quality, while more increases evaluation effort without improving decision accuracy.

How do you verify a vendor’s real capability?

The most reliable methods are:

- Reviewing relevant case studies

- Speaking with past clients

- Meeting the actual delivery team

- Running a pilot project or discovery sprint

Marketing materials alone are not sufficient proof.

How long does a proper vendor selection process take?

A well-structured process typically takes 3–6 weeks, depending on complexity and stakeholder involvement. Rushed decisions often lead to longer delays later.

Jan 31, 2026

Jan 31, 2026